GourmetBites Bakery

Profitability

Framework

Difficulty

Times Practiced

Overview

GourmetBites Bakery, a renowned chain known for its artisanal breads, pastries, and cakes, is facing a challenge with declining profitability despite a loyal customer base and a strong reputation for quality. This case study invites candidates to use the profitability framework to conduct a thorough analysis of the bakery’s financial performance, product mix, pricing strategy, and operational efficiency. This case study tests the candidate’s analytical skills, financial acumen, and strategic thinking in a real-world business context.

Prerequisite Knowledge:

- Knowledge of, and ability to calculate, Contribution Margin.

- Understanding of Revenue and Cost drivers.

- Ability to perform simple multiplication and division by hand.

The Case

Background:

GourmetBites Bakery is a beloved chain that has been serving artisanal breads, pastries, and cakes for over a decade. Known for its use of high-quality ingredients and traditional baking techniques, the bakery has built a strong reputation and a loyal customer base. However, despite its success in maintaining product quality and customer satisfaction, GourmetBites has witnessed a decline in profitability over the past two years. The management is concerned about this trend and seeks to understand the underlying causes and identify strategies to improve the financial health of the business. GourmetBite has not introduced or eliminated any products from its menu over the past three years.

Objective:

The primary objective is to conduct a comprehensive analysis using the profitability framework to advise the bakery on next steps to turn profitability around.

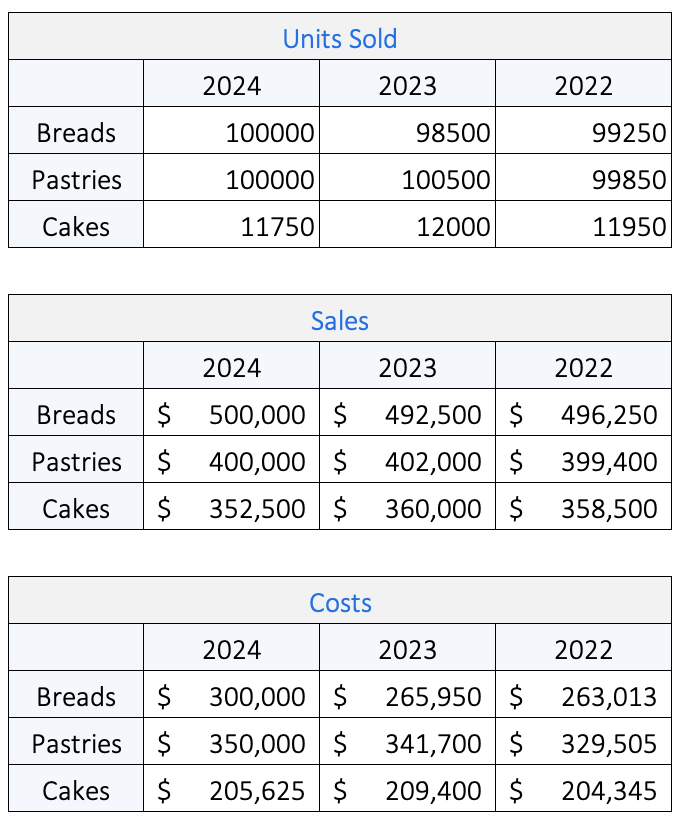

Data Provided for Analysis:

Your Assignment

Product Profitability Analysis:

- Calculate the contribution margin for each product line.

- Assess the impact of sales volume on the overall profitability of each product line.

- Provide the client with a ‘Next Steps’ recommendation.

Hear from the experts

Remember, the focus is profitability. Given the limited data, you are going to be expected to conduct a high level analysis fairly quickly. This case tests your understanding of the profitability framework without the need to analyze product level performance.

Profit = Revenue – Costs.

At a high level the units sold remained fairly consistent year-over-year for each product. This implies demand has remained relatively unchanged. Sales also mimic units sold, meaning the price for each unit has remained unchanged (we would see an uptick in sales if the price per item increased). Therefore, without the need to perform any math, you can quickly conclude the business problem lies in Costs. Start by dividing the annual cost of each product by its units sold. This will require basic long division, but you’ll quickly notice costs have been increasing year-over-year for each product. As next steps, I would advise the interviewer of your findings and the need for relevant cost data for each product.

If you start by calculating the contribution margin for each product, you’ll notice that the contribution of each product has remained constant over the years. No single product is causing a profit decline; rather, all products are potentially contributing to it. To simplify the analysis, I calculated the average units sold, sales, and costs for each product over three years. Most averages closely aligned with the annual values, except for costs, which showed the largest variance between the minimum, maximum, and average values. This suggests that further exploration into cost management strategies could be beneficial.

Based on my experience, if a client is unaware of the causes of a decline in profitability, there are likely underlying cost issues that may have gradually emerged or have not been properly allocated. Clients are typically aware if they’ve reduced the price of a product or if it’s not selling in similar volumes to previous years. While you can assume this to demonstrate your understanding of the challenges clients face, it’s always wise to review the data to confirm.

Quickly divide Costs by Units Sold. For each product, observe how cost is increasing year-over-year. If you have time, you can also divide Sales by Units Sold. Doing so you’ll conclude that the price of each product has remained unchanged for the past three years will costs have slowly increased.

Approach & Solution

Approach:

Understand the Problem: Clarify the objective, which is to improve profitability by using the provided sales and cost data.

Analyze the Data:

- Calculate the contribution margin for each product line by subtracting the costs from the sales.

- Determine the contribution margin ratio to understand the profitability relative to sales.

- Analyze the profit volume ratio to assess the profitability per unit sold.

Evaluate Trends:

- Look at changes in units sold, sales, and costs over the years for trends.

- Identify which products are gaining or losing profitability.

Strategic Financial Assessment:

- Identify high-margin products that could be focused on to improve profits.

- Review pricing strategies for each product line to find opportunities for improvement.

- Consider cost-reduction strategies for products with lower margins.

Operational Review:

- Examine operational efficiencies and how they impact the cost and profitability of each product line.

- Look for opportunities to optimize operations to reduce costs without compromising quality.

Market Consideration:

- Consider market trends, competition, and customer feedback for strategic decisions.

- Identify opportunities to develop new products or alter existing ones to meet consumer demand.

Create Actionable Steps:

- Focus on actionable strategies such as product development, marketing initiatives, pricing adjustments, and cost controls.

- Prioritize actions based on the potential impact and feasibility.

Communication:

- Clearly communicate the findings and recommendations to the client.

- Use visuals and summaries to make the data easily understandable.

By systematically analyzing the data, considering operational and market factors, and focusing on profitability levers, one can develop a solid strategy to improve the financial performance of the business.

Contribution Margin for Each Product Line:

- Breads:

- 2024: $200,000

- 2023: $226,550

- 2022: $233,237

- Pastries:

- 2024: $50,000

- 2023: $60,300

- 2022: $59,895

- Cakes:

- 2024: $146,875

- 2023: $150,600

- 2022: $154,155

Contribution Margin Ratio (Contribution Margin / Sales):

- Breads:

- 2024: 40%

- 2023: 46%

- 2022: 47%

- Pastries:

- 2024: 12.5%

- 2023: 15%

- 2022: 15%

- Cakes:

- 2024: 41.67%

- 2023: 41.83%

- 2022: 43%

Profit Volume Ratio (Contribution Margin / Units Sold):

- Breads:

- 2024: $2.00 per unit

- 2023: $2.30 per unit

- 2022: $2.35 per unit

- Pastries:

- 2024: $0.50 per unit

- 2023: $0.60 per unit

- 2022: $0.60 per unit

- Cakes:

- 2024: $12.50 per unit

- 2023: $12.55 per unit

- 2022: $12.90 per unit

Assessment and ‘Next Steps’ Recommendation:

The data indicates that breads have the highest contribution margin in terms of total dollars, but cakes have the highest profitability per unit sold and the highest contribution margin ratio.

To improve overall profitability, consider the following steps:

-

Focus on High-Margin Products: Since cakes have the highest margin per unit, efforts could be focused on increasing the sales volume of cakes without significantly increasing costs.

-

Pricing Strategy Review: Given the consistency in the high contribution margin ratio of bread, an evaluation of the pricing strategy for breads may reveal opportunities for price optimization.

-

Cost Analysis: Further analyze the costs associated with pastries. Despite having a reasonable sales volume, their contribution margin is the lowest. Streamlining production or renegotiating supplier contracts could improve margins.

-

Sales and Marketing Initiatives: Intensify marketing efforts for the most profitable items, and consider cross-selling strategies or bundling to leverage the popularity of the breads.

-

Operational Efficiency: Since the bakery has seen a rise in the contribution margin for breads, there may be operational efficiencies or economies of scale at play. Further investigation into operational practices could provide insights for efficiency improvements across all product lines.

-

Product Development: Considering consumer feedback on product variety and pricing, GourmetBites Bakery might benefit from introducing a line of premium breads or cakes to cater to different market segments and further enhance profitability.

The bakery should prioritize these initiatives based on potential impact and resource requirements to ensure an effective approach to improving profitability

Email us at Inquiry@TheCaseRound.com

At The Case Round, we recognize the urgency often required for last-minute interviews, so we guarantee a response within hours of your submission.